City of Tempe, AZ

Home MenuGovernment » Financial Services » Sales Tax & Regulatory Licenses

Transaction Privilege Tax (TPT or Sales Tax)

Apply, File & Pay at www.AZTaxes.gov

Get free City of Tempe business news emailed to you.

Notice of Upcoming Residential Rental Tax Changes

Effective Jan. 1, 2025 the City of Tempe will no longer impose Transaction Privilege Tax (TPT) on income received from residential rentals with stays of 30 days or more also known as long-term rentals (business code: 45).

Rents received for periods December 2024 and prior remain taxable, including unlicensed properties and/or returns that may not have been filed and/or paid. The December 2024 reporting period (Due Jan. 20, 2025) is still required to be filed and paid.

Short-term rentals (less than 30 days) and commercial leases are not impacted and remain taxable.

Please refer to the Arizona Department of Revenue for further details.

Transaction Privilege Tax (TPT) is actually a tax on a vendor for the privilege of doing business in the state. Various business activities are subject to Transaction Privilege Tax and must be licensed.

If a business is selling a product or engaging in a service subject to TPT, a license from the Arizona Department of Revenue (ADOR) would likely be needed as well as a transaction privilege tax or business/occupational license from the city or cities in which the business is based and/or operates.

ADOR collects the tax for the counties and cities; however, tax rates vary depending on the type of business activity, the city and the county.

Apply, File & Pay Transaction Privilege Tax (TPT or sales tax) at AZTaxes.gov

Click The Logo Below To View The Model City Tax Code:

Notice of Upcoming Residential Rental Tax Changes

Effective Jan. 1, 2025 the City of Tempe will no longer impose Transaction Privilege Tax (TPT) on income received from residential rentals with stays of 30 days or more also known as long-term rentals (business code: 45).

Rents received for periods December 2024 and prior remain taxable, including unlicensed properties and/or returns that may not have been filed and/or paid. The December 2024 reporting period (Due Jan. 20, 2025) is still required to be filed and paid.

Short-term rentals (less than 30 days) and commercial leases are not impacted and remain taxable.

Please refer to the Arizona Department of Revenue for further details.

Taxable Business Activities in Tempe subject to TPT:

Details on Taxable Business Activities

Tempe Tax Code And Regulations

CITY/TOWN NAME: TEMPE |

CITY CODE: TE |

BUSINESS CODE |

TAX RATE |

COUNTY: MAR |

|---|---|---|---|---|

| Advertising | 018 | 1.80% | ||

| Amusements | 012 | 1.80% | ||

| Contracting-Prime | 015 | 1.80% | ||

| Contracting-Speculative Builders | 016 | 1.80% | ||

| Contracting-Owner Builder | 037 | 1.80% | ||

| Job Printing | 010 | 1.80% | ||

| Manufactured Buildings | 027 | 1.80% | ||

| Timbering and Other Extraction | 020 | 1.80% | ||

| Severance-Metal Mining | 019 | 0.10% | ||

| Publication | 009 | 1.80% | ||

| Hotels | 044 | 1.80% | ||

| Hotel/Motel (Additional Tax) | 144 | 5.00% | ||

| Residential Rental, Leasing & Licensing for Use | 045 | 1.80% | ||

| Commercial Rental, Leasing & Licensing for Use | 213 | 1.80% | ||

| Rental, Leasing & Licensing for Use of TPP | 214 | 1.80% | ||

| Restaurants and Bars | 011 | 1.80% | ||

| Retail Sales | 017 | 1.80% | ||

| Retail Sales Food for Home Consumption | 062 | 1.80% | ||

| MRRA Amount | 315 | 1.80% | ||

| Communications | 005 | 1.80% | ||

| Transporting | 006 | 1.80% | ||

| Utilities | 004 | 1.80% | ||

| Use Tax Purchases | 029 | 1.80% | ||

| Use Tax From Inventory | 030 | 1.80% |

Apply, File & Pay Transaction Privilege Tax (TPT or sales tax) at AZTaxes.gov

See video tutorials on how to file and pay. Please know that even if your business has $0 sales for the month or filing period, you must still file for that period.

Setup your AZTaxes.gov account:

Where can I View Available Deductions for TPT?

Deduction Codes

Transaction privilege tax deduction codes are used in Schedule A of Forms TPT-2 and TPT-EZ to deduct income exempt or excluded from tax, as authorized by Arizona statute and/or the Model City Tax Code. The same region codes used in reporting income are used in Schedule A to claim deductions of nontaxable or exempt income.

For instance, a pharmacy’s income from sales of prescription drugs is specifically exempt from both state and city transaction privilege tax. The pharmacy will report all of its gross income under each correct region code and deduct the income from sales of prescription drugs on Schedule A. Appropriate taxes will then be paid on all of the pharmacy’s income not deducted on Schedule A.

TPT deduction code listings provide the deduction code number, a description (often abbreviated) and the business codes for state and city business categories. A deduction code can often be used under both state and city business codes, but some deductions apply only to state business codes and some apply only to city business codes.

Step by Step Guide to completing a return on AZTaxes.govAZTaxes.gov: New User Registration |

AZTaxes.gov: TPT Filing |

AZTaxes.gov: Making a TPT Payment |

AZTaxes.gov: Linking an Existing Business Tax Account to a User Profile |

|

How To File/How To Report Deductions/How To View Filing History in AZTaxes.gov

How To Make An Update To Your TPT License (example: mailing address, DBA name, add a new location, add new officers or update who has access to your account on AZTaxes.gov)

How To Add a new location or new Jurisdiction to an existing Transaction Privilege Tax (TPT) license on AZTaxes.gov - click here |

If the refund claim is for six months or less, it is recommended to file an amended return through:

If the refund claim exceeds six months, it is recommended to submit a written refund claim through ADOR:

1) Download the Refund Request Workbook to your desktop.

2) Thoroughly complete the Refund Request Workbook (Instructions also included in Workbook).

- Click on the Start Tab.

- Fill out the general account information

- Amended Deduction Detail Tab

- Enter the information applicable to the refund claim at the transaction level.

- Provide the correct deduction codes for the transactions.

- Include the amount of tax that should be refunded.

- Provide additional comments as necessary.

- Provide additional documentation for each month within the refund period

- Invoices

- Exemption Certificates

- Additional return back-up information

- Contracts for new deductions claimed (if applicable)

3) Please email the completed forms and additional documents to TPTRefunds@azdor.gov.

You may also mail your completed forms and documents to:

Arizona Department of Revenue TPT Refund Request

Division Code 16

1600 W Monroe St.

Phoenix, AZ 85007

4) What to expect

-

- A preliminary review will be conducted to ensure that all documentation has been provided with your refund claim.

- A Refund Request Number is assigned once all documentation has been received.

- The claim is put in queue and will be assigned to a TPT auditor for review.

- An assigned TPT auditor will contact the appointee in the POA/Disclosure Authorization Form to review supporting claim documents.

- The Determination Letter is emailed to the appointee.

*The Arizona Department of Revenue maintains the right to request additional documentation if necessary to complete the review of a refund claim. If the information is not provided upon request, the documentation may be subpoenaed by the department.

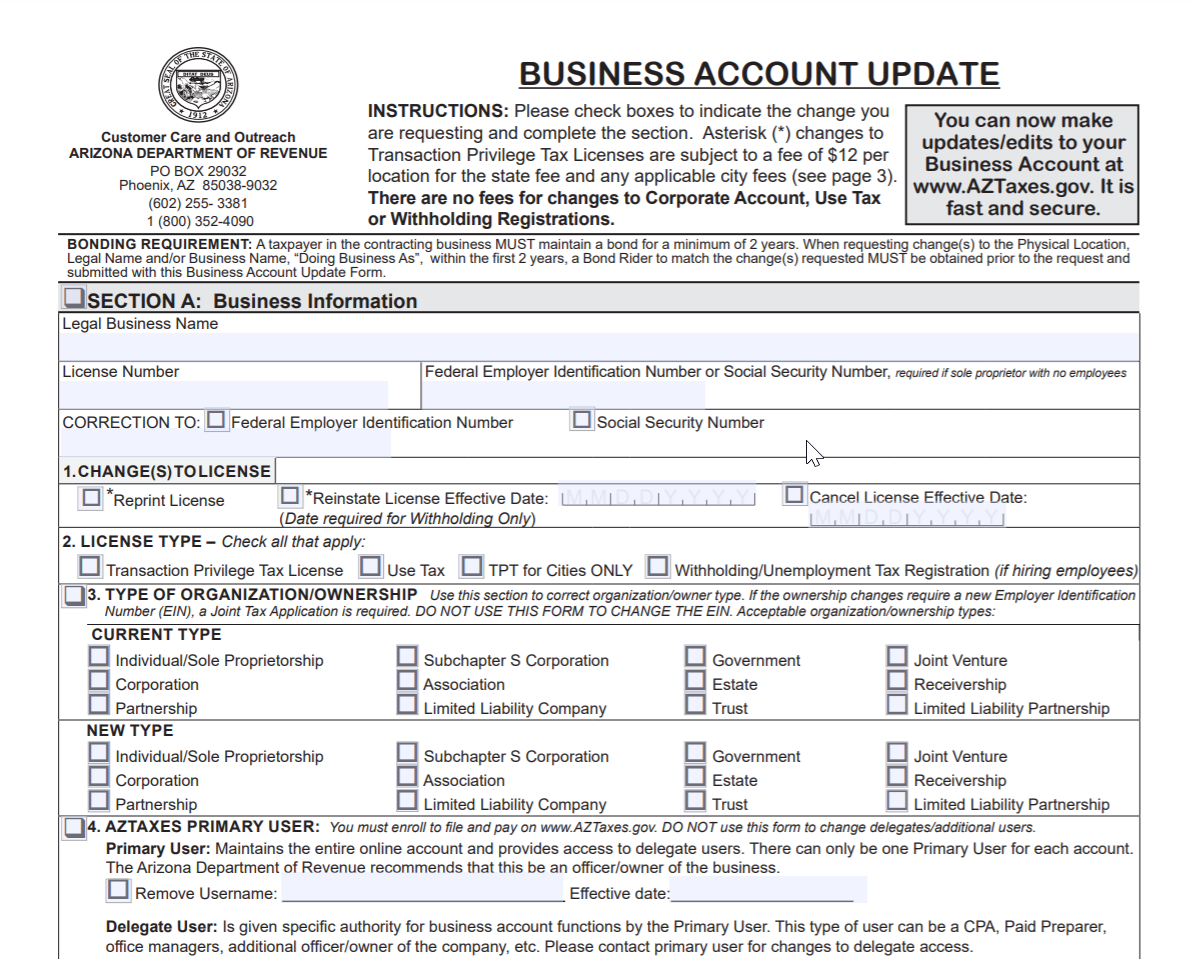

There are two ways to do a Business Account Update for your Transaction Privilege Tax license:

1)  Click for online

Click for online

2)  Click for paper

Click for paper

Video On How To Make An Update To Your TPT License (example: mailing address, DBA name, add a new location, add new officers or update who has access to your account on AZTaxes.gov)

What can you use a Business Account Update for?

Report your business changes:

- change your mailing address on corporate, withholding and transaction privilege and use tax licenses;

- add, edit and/or close locations for TPT licenses;

- cancel or close an existing TPT license or single location on a TPT license;

- close an account for withholding or TPT licenses;

- make changes to “Doing Business As” (DBA) name or the business mailing address;

- and/or add a new reporting jurisdiction, new business code or business or rental location

When locations are added or there are changes in the business name (or DBA) the license number does not change; however, a new license is printed showing the updated information.

License fees are required whenever these changes are made and the business receives a new print of the license.

Other business changes that should be reported to the Department of Revenue include changes in the mailing address or location of audit records, addition or removal of owner/officer information, requests to cancel your license when the business plans to cease operations, and requests to change filing frequency.

These changes do not require a license fee.

Note: Changes in ownership require a new license because licenses are not transferable.

Use the Arizona Joint Tax Application to apply for a new license if your business changes from a sole proprietorship to a partnership or corporation, or undergoes a similar change in organization.

Also, if the business is a partnership and partners are added or removed, a new license is required.

Marijuana Taxation Guidance

Proposition 207, the Safe and Smart Act, passed into law in November 2020 and legalized marijuana for adult personal use. The statutory provision Prop 207 is found in Arizona Revised Statutes (A.R.S.) Title 36, Chapter 28.2. This voter initiative allows adults over the age of 21 to possess, purchase, transport, or process 1 ounce or less of marijuana or 5 grams or less of marijuana concentrate. The Arizona Department of Health Services (ADHS) is responsible for licensing and regulating marijuana, marijuana retail sales, marijuana growth, and testing facilities in Arizona. The Arizona Department of Revenue (ADOR) is tasked in A.R.S. Title 42, Chapter 5, Article 10 with collecting the excise tax (imposed only by the state) and transaction privilege tax (state, counties, and cities) imposed on adult use marijuana sales.

Medical Marijuana

Medical marijuana dispensaries in Arizona are subject to state and local retail TPT on their sales of medical marijuana and other products sold at the dispensaries. They must hold a current TPT license with ADOR and file and pay retail TPT on these sales.

Adult Use (Non-medical) Marijuana

Adult use marijuana establishments in Arizona are subject to state and local retail TPT on their adult use marijuana sales and other products. Adult use marijuana establishments must report such sales using a new Adult Use Marijuana business code on Form TPT-2.

In addition to retail TPT, adult use marijuana retail sales are also subject to a 16% state Marijuana Excise Tax (MET). This tax must be reported on Form MET-1, which is separate from and in addition to Form TPT-2. To file and pay MET, an adult use marijuana establishment must register with ADOR in addition to applying for a TPT license.

For More Information contact the Arizona Department of Revenue or visit:

TPT Thresholds

Businesses with an annual transaction privilege tax and use tax liability of $500 or more during the prior calendar year are required to file and pay electronically.

Failure to comply with the electronic filing and payment requirements may result in penalties.

| YEAR | E-FILE AND E-PAY THRESHOLD |

|---|---|

| 2021 | $500 annual liability |

Penalty for not filing and paying electronically:

- Taxpayers required to file an electronic return will be subject to a penalty of 5 percent of the tax amount due for filing a paper return. The minimum penalty is $25, including filings with zero revenues for a filing period.

- Taxpayers required to pay electronically will be subject to a penalty of 5 percent of the amount of payment made by check or cash.

- Taxpayers who file their tax return late will be subject to a late file penalty of 4.5 percent of the tax required to be shown on the return for each month or fraction of a month the return is late. There is a minimum of $25 and a maximum 25 percent of the tax due or $100, per return, whichever is greater.

Closed or No Sales: Even if you had no sales and/or tax due for a filing period, you must still file a $0 TPT return on AZTaxes.gov. Failing to do so will result in a $25 penalty from ADOR.

Third-Party Prepared Food Delivery Companies

From ADOR: It is our understanding that with the recent legislation passed in Arizona regarding economic nexus that some prepared food delivery (PFD) companies believe their business activity falls within the definition of a “marketplace facilitator.”

The Arizona statutes define a marketplace facilitator as a person or business operating a marketplace and facilitating retail sales. Third-party prepared food delivery companies are not “marketplace facilitators.”

The main difference is that these companies do not facilitate retail sales. Third-party prepared food delivery companies facilitate restaurant sales and transport food between the restaurant and consumer. As such, these companies are not a marketplace facilitator by definition.

The restaurant’s sales are taxable under the restaurant classification. The restaurant must report and remit the TPT on the full price of the prepared food (even if a portion is retained by PFD) because they are engaged in a taxable activity.

General Rights As A Taxpayer

- You will always be treated fairly and with courtesy by our employees.

- Financial information will be kept confidential.

- Whether you contact the tax office in person, by letter, or by telephone, your questions will be answered promptly and accurately.

- Employees are not evaluated by the amount of taxes they collect or assess. (Sec. 16-517)

- Refund requests will be promptly reviewed and issued.

- Any interviews relating to an audit or a deficiency in payment of any tax will be conducted at your place of business or at our office, and will be held at a reasonable time. During the interview, you will be given information about your rights, the audit, how an audit can be amended, and appeal procedures regarding any amount you might owe.

- If we have sent you an assessment (the official notice of the amount of tax we have determined you owe) for any particular tax period, that assessment cannot be increased except in specific limited circumstances. Once the tax office completes an audit and a tax deficiency has been determined, your liability for that particular tax for the period included in the audit is fixed, and no additional audit may be conducted, except under specific limited circumstances. (Sec. 16-556)

Reliance On Written Information

Although the tax office is confident that the oral responses given by its employees to taxpayer questions are correct, the City is not bound by that oral advice. We encourage you to put your questions in writing, and we will answer you in writing. This will reduce the chances of misunderstanding. If you underpay your tax as a direct result of following the written advice we have given you, an instruction on a tax report form, or a tax office tax ruling, you will not have to pay interest or penalties on that tax.

Where Do I Find The Interest Rates Charged By ADOR For Outstanding Transaction Privilege Tax Owed?

When are TPT filing and payments due?

The monthly tax return is due on the 20th of the month following the reporting month. The quarterly tax return is due on the 20th of the month following the end of the quarter. Postmarks are not proof of timely filing. It is highly recommended to file and pay using AZTaxes.gov to expedite processing.

If my business is Temporarily Closed or I have had no sales ($0), do I still need to file my Transaction Privilege Tax return on AZTaxes.gov?

Yes, even if you had no sales and/or tax due for a filing period, you must still file a $0 TPT return. Failing to do so will result in a $25 penalty from ADOR.

How do I find more details on Transaction Privilege Tax and language in the Model City Tax Code?

Where can I find deduction codes available for Transaction Privilege Tax?

DEDUCTION CODES

"Our mission is to provide quality service to all Tempe taxpayers, and administer the tax code in a fair and equitable manner."

| Tempe Tax & License | Office Address | Mailing Address |

| Mon - Fri, 8am - 5pm | City of Tempe | City of Tempe |

| (except City holidays) | Tax and License | Tax and License |

| Phone: 480-350-2955 | 20 E. 6th St., 3rd Floor | P.O. Box 5002 |

| Fax: 480-350-8659 | Tempe, AZ 85281 | Tempe, AZ 85280 |

| salestax@tempe.gov |