Property Management Companies

Property Management Companies(PMC's) are commonly a third party company that acts in fiduciary capacity on behalf of the owners of real estate. Property manager responsibilities include day-to-day operations of the real estate, from screening tenants to arranging for repairs and maintenance. Owners pay property managers a fee or a percentage of the rent generated by the property.

1) PMC's Are Required To Register With The Arizona Department of Revenue per A.R.S § 42-5005(M) To File & Pay Transaction Privilege Tax(TPT) On Behalf Of The Property Owner

Form 11348 - Property Management License Application & Memorandum of Understanding

Property Management Companies (PMC) can file on behalf of the property owners pursuant to A.R.S § 42-5005(M). Licensure is required for the PMC to act in a fiduciary capacity as the agent of the property owner in accordance with A.R.S § 42-6013.

Property owners must have their own Transaction Privilege Tax license and allow the PMC to file and pay TPT on their behalf.

A PMC filing an electronic consolidated return:

(a) Acts in a fiduciary capacity as the property owners' agent.

(b) Is responsible and accountable to the property owners and to the city or town for fully and accurately reporting and paying to the department the tax and any other amounts due.

(c) Is subject to audit, as provided by law, of the electronic consolidated returns, including data in the licensee's possession that is used in compiling and filing the electronic consolidated returns.

(d) Notwithstanding section 42-1129, subsection A, shall remit the applicable tax in monies that are immediately available to this state on the date of the transfer in accordance with section 42-1129, subsection B.

Property owner(s):

(a) Remains ultimately responsible, accountable and liable for both:

(i) The accuracy of information the property owner furnishes to the licensee.

(ii) The return and payment of the full tax liability, including any penalties prescribed by section 42-1125.

(b) Is subject to audit, as provided by law, of the records in the property owner's possession that are submitted to the licensee for the purposes of the electronic consolidated return.

(c) May withdraw any of the property owner's properties from the electronic consolidated return on thirty days' written notice to the licensee, the department and the tax collector of the city or town.

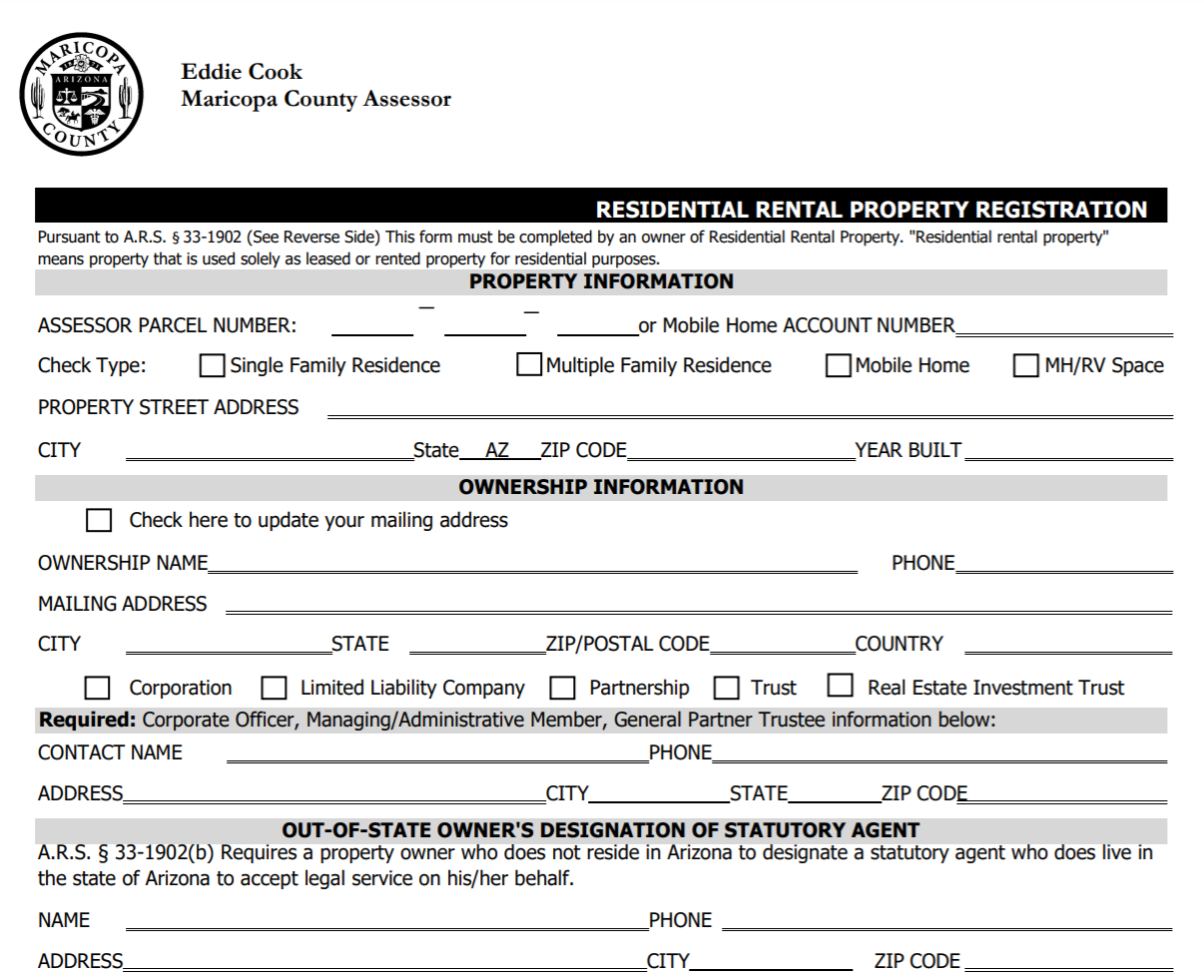

2) Tempe Residential Long-Term and Short-Term Rental Properties Are Required To Register With The Maricopa County Assessor. Click Image Below:

3) A Transaction Privilege Tax (TPT or sales tax) License is required annually for every single residential rental property located in Tempe whether it is a long-term or short-term rental

Apply, File & Pay Transaction Privilege Tax at AZTaxes.gov

4) What Training Or Assistance Is Available for PMC's?

a. PMC Checklist for PMC Licensing, Filing & Paying - click here

b. PMC Filing & Paying Tutorial

c. Live PMC Workshops

d. ADOR Contact Info:

Property Owners: ResidentialRental@azdor.gov

Property Managers Hotline: 602-716-7368(R-E-N-T)

Property Owners: 602-255-3381 (ask to be transferred to Residential Rental Hotline)